Ia Wealth Management Can Be Fun For Everyone

Wiki Article

The Main Principles Of Independent Investment Advisor Canada

Table of ContentsThe Main Principles Of Independent Financial Advisor Canada The Basic Principles Of Independent Investment Advisor Canada The Best Guide To Investment RepresentativeThe Private Wealth Management Canada IdeasThe Only Guide for Ia Wealth Management4 Simple Techniques For Retirement Planning CanadaThe Facts About Private Wealth Management Canada UncoveredLittle Known Questions About Financial Advisor Victoria Bc.9 Easy Facts About Investment Representative Shown

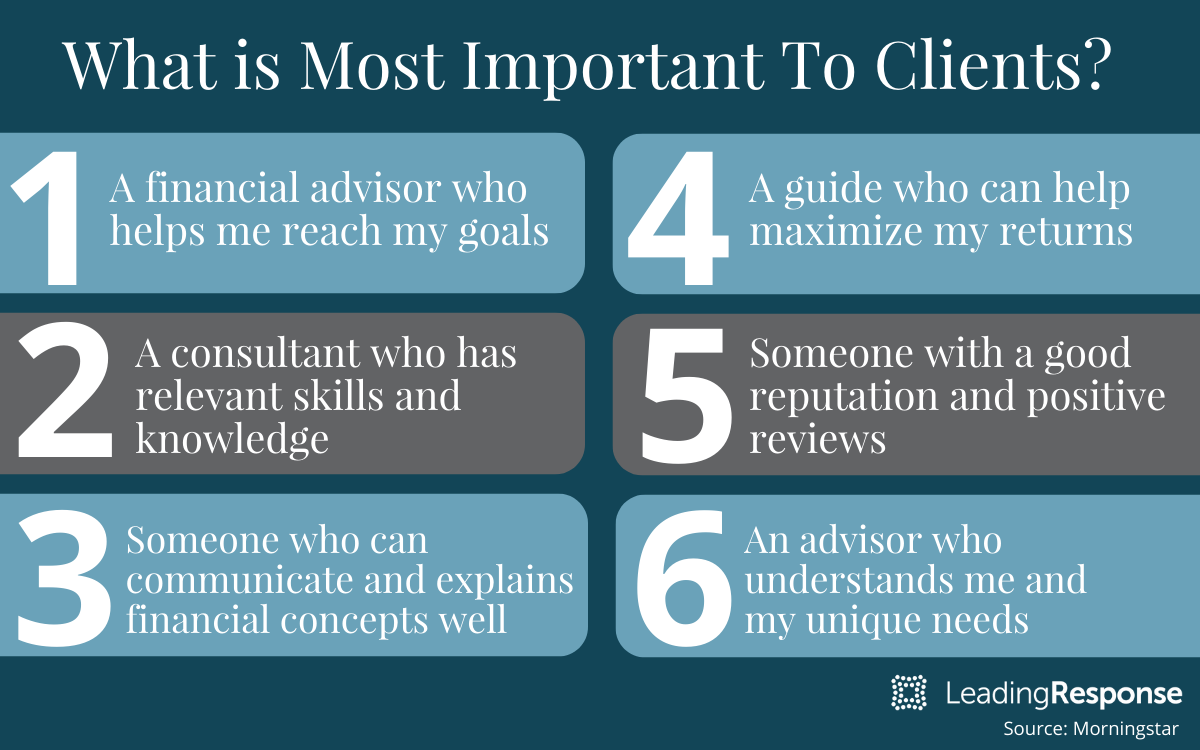

They make cash by asking a fee for each trade, a set monthly fee or a share fee based about buck level of assets being managed. People searching for ideal specialist should ask a many concerns, such as: A financial specialist that really works along with you will likely not function as the just like a monetary expert which works with another.Based on whether you’re trying to find a wide-ranging monetary program or are just looking financial investment direction, this concern can be important. Investment analysts have actually different ways of charging you their clients, and it surely will often be determined by how often you utilize one. Make sure to ask in the event that consultant employs a fee-only or commission-based system.

Our Retirement Planning Canada Statements

When you may need to put in some work to choose the best financial expert, the work tends to be worth every penny if the specialist offers good advice and assists place you in a significantly better budget.

Vanguard ETF Shares aren't redeemable right utilizing the providing fund besides in massive aggregations really worth millions of dollars (https://fliphtml5.com/dashboard/public-profile/cibon). ETFs tend to be at the mercy of market volatility. When buying or offering an ETF, you'll shell out or get the market rate, which can be pretty much than net resource value

Some Of Independent Financial Advisor Canada

Normally, though, a monetary expert will have a education. Whether it’s not through an academic system, it’s from apprenticing at a financial consultative firm (https://padlet.com/carlosprycev8x5j2/lighthouse-wealth-management-a-division-of-ia-private-wealth-nb61uqub0429yw8i). People at a company that are however mastering the ropes are usually called acquaintances or they’re part of the management staff members. As mentioned previous, though, many advisors result from various other areas

Private Wealth Management Canada - The Facts

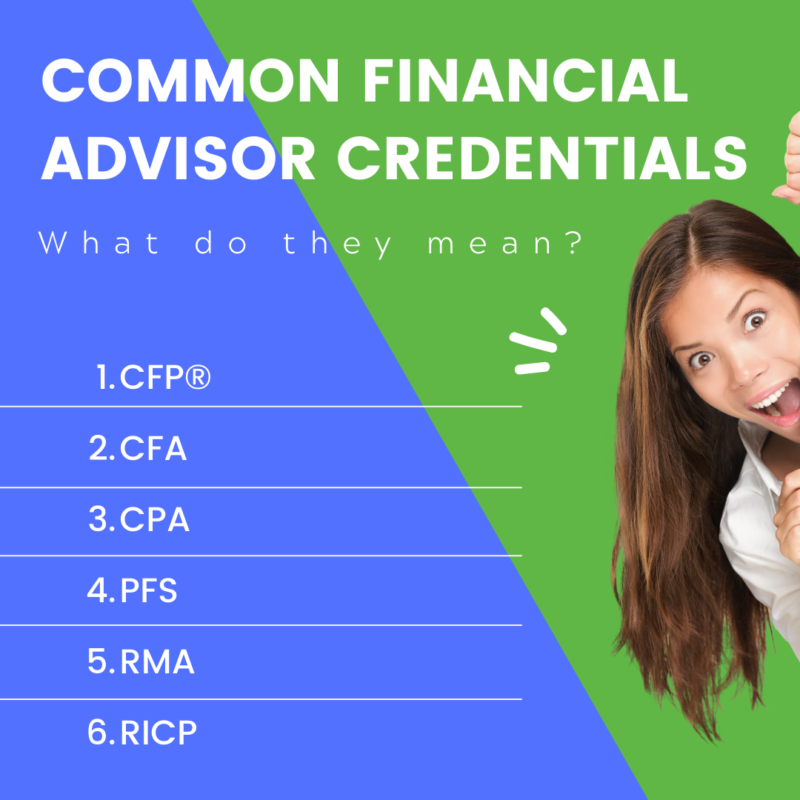

This implies they have to place their customers’ best interests before their, on top of other things. Various other financial advisors tend to be members of FINRA. This can indicate that these are typically agents which additionally provide financial investment information. As opposed to a fiduciary criterion, they legitimately must follow a suitability standard. This means that there is a fair foundation due to their investment suggestion.Their unique labels typically state it-all:Securities certificates, on the other hand, tend to be more concerning the product sales side of investing. Financial experts who are additionally agents or insurance coverage representatives are apt to have securities permits. Should they straight buy or sell shares, bonds, insurance coverage products or give monetary information, they’ll require particular licenses pertaining to those products.

Some Known Facts About Lighthouse Wealth Management.

Constantly be sure to inquire about about economic experts’ charge schedules. To get these details independently, check out the firm’s Form ADV this files aided by the SEC.Generally speaking, there are two types of pay frameworks: fee-only. independent investment advisor canada and fee-based. A fee-only advisor’s sole kind payment is by client-paid charges

When wanting to understand how much cash a financial expert prices, it’s crucial that you know there are various of payment practices they might make use of. Here’s an introduction to everything you might run into: monetary advisors can get compensated a percentage of the as a whole possessions under management (AUM) for dealing with your cash.

Getting The Financial Advisor Victoria Bc To Work

59% to 1. 18%, normally. retirement planning canada. Generally, 1percent is seen as the industry standard for approximately a million bucks. Lots of analysts will reduce the portion at larger degrees of assets, thus you are paying, state, 1percent the very first $1 million, 0. 75per cent for the following $4 million and 0Whether you need a financial expert or not is determined by just how much you have got in assets. Opt for your own comfort level with money management subjects. When you have an inheritance or have recently come right into a large amount of cash, subsequently an economic expert may help reply to your economic questions and arrange your cash.

Investment Representative for Beginners

Those distinctions might appear clear to individuals in the expense market, but many people aren’t conscious of them. They could contemplate monetary preparation as interchangeable with financial investment control and guidance. And it’s correct that the contours amongst the occupations have grown blurrier before couple of years. Investment experts are progressively concentrated on supplying alternative financial planning, as some customers look at the investment-advice portion becoming just about a commodity and they are seeking wider knowledge.

If you’re getting holistic preparation information: A financial planner is acceptable if you’re seeking broad financial-planning guidanceon your own investment profile, but the rest of the plan as well. Find those people that name by themselves monetary coordinators and get prospective coordinators if they’ve earned the qualified monetary planner or chartered financial specialist designation.

Some Known Questions About Independent Investment Advisor Canada.

If you need investment information first off: if you were to think your financial plan is in sound condition total you need help selecting and supervising your own investments, a financial investment consultant will be the route to take. These types of individuals are generally authorized investment review analysts or are employed by a firm this is certainly; these experts and advisory agencies are held to a fiduciary requirement.If you'd like to assign: This setup can make feeling for very busy people that merely do not have the time or tendency to participate in inside the planning/investment-management procedure. It is also something you should think about for earlier investors who happen to be worried about the potential for intellectual decrease and its own impact on their ability to handle unique finances or expense portfolios.

The Best Guide To Independent Investment Advisor Canada

Mcdougal or writers do not very own shares in almost any securities mentioned in this article. Know about Morningstar’s article policies.Just how near one is to retirement, for instance, or the effect of major existence events such as for instance matrimony or having kids. But these specific things aren’t within the control of a monetary planner. “Many occur arbitrarily as well as aren’t some thing we could influence,” claims , RBC Fellow of Finance at Smith class of Business.

Report this wiki page